Is Paypal A Payment Gateway

Work solely with PayPal. PayPal Website Payments Pro offers everything a merchant needs to do business online.

PayPal Payment Gateway Receive payments through PayPal Pro. Calls from other networks may vary and from mobiles will cost considerably more.

Is Paypal A Payment Gateway

” Sure, Shopify Payments do charge a payment gateway fee, but you have to pay this regardless of which payment gateway you use anyway.” So if they charge a payment gateway fee, what am I saving again? I looked through your article again and I STILL don’t see the “Gateway fee” that they charge for using Shopify payments and how much it is. Already using a Payment Gateway? Add Express Checkout to your payment solution. Includes 3-click checkout, payment processing by phone, post, online invoicing and eBay. Here are a few:

Payflow is a secure, open payment gateway. You can also select PayPal as your credit card processor (see PayPal Payments Pro). Additional charges apply for currency conversions and cross border payments as well as refunds and chargebacks. that they don’t word things plainly in order to avoid confusion. Includes 3-click checkout, payment processing by phone, post, online invoicing and eBay. PayPal Payment Gateway Receive payments through PayPal Pro. We’ve designed a quick and simple integration process that fully sets up your payment gateway in your online Shopify store so you can start accepting credit card payments right away.

Is Paypal A Payment Gateway

PayPal and PayPal Credit transactions are processed quickly, and the money usually shows up in your PayPal account within minutes. No hidden costs. Get Started Now or Call Sales on 0844 338 0470* Get Started * Calls cost 5p per minute from a BT landline (minimum charge 5.5p). Merchants who want total control over the checkout experience can host their own checkout pages and send transactions to Payflow via an API. Over two million brands trust their online payments to PayPal. Depending upon your merchant account provider, credit card transactions typically fund between 1-3 business days.

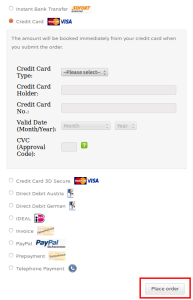

For nearly a decade, independent ecommerce sites have been using PayPal for payment processing because it avoids the hassles associated with merchant accounts, online credit card transactions and returned charges. Website Payments Pro clients get set up with a merchant account and can begin processing credit cards online. And Shopify is here to help you take it the rest of the way. It also lets merchants accept PayPal and PayPal Credit® (formerly Bill Me Later® ) payments. Design and control you customers’ checkout experience from start to finish. PayPal also offers merchant accounts to go with the Payflow payment gateway. When a customer submits payment through the Payflow Pro gateway, they don’t go to PayPal’s website to sign in. The impression that I get reading this article, shopify’s statements and the various comments by people using it is that they are NOT upfront about their fee structure before you sign up. Your monthly sales Up to £1,500 £1,500 – £6,000 £6,000 – £15,000 £15,000 – £55,000 + £55,000 Transaction fee 3.4% + 20p 2.9% + 20p* 2.4% + 20p* 1.9% + 20p* 1.4% + 20p* Non profit discounted rate 1.4% + 20p Micropayments** 5% + 5p *You can apply for these Merchant Rates if you’ve received more than £1,500.00 GBP in PayPal payments in the previous calendar month. that they don’t word things plainly in order to avoid confusion. Find the right solution for you. To apply call us on 0844 338 0470 This pricing table shows the transaction fees for domestic payments in UK Sterling. The impression that I get reading this article, shopify’s statements and the various comments by people using it is that they are NOT upfront about their fee structure before you sign up. It will also handle autocharges for subscription or payment plans (PayPal charges an extra fee for recurring billing). One provider and one solution. Work solely with PayPal. Use Payflow Gateway to process debit and credit card payments, PayPal, PayPal Credit, authorizations, captures, and credit voids.

Is Paypal A Payment Gateway

When you integrate with the PayPal Payflow Pro merchant gateway, you are able to process payments through any method (order forms, shopping cart, or manual orders). PayPal is only running on the back-end to process the payment.

There is a huge number of online payment methods in use around the world, from the well-known and well-established Visa and MasterCard to very niche payment methods used in just one or two countries. Quickly and easily enable PayPal Express Checkout to benefit from increased sales. Design and control you customers’ checkout experience from start to finish. This reminds me of a board I was on ON the Shopify site where people were burdened in confusion over shopify’s convoluted fee policy statements and the lack of clarifying responses to their questions BY shopify.

JustTellMeHowMuchItIsAlready April 10, 2014 at 3:25 PM # ” Sure, Shopify Payments do charge a payment gateway fee, but you have to pay this regardless of which payment gateway you use anyway.” So if they charge a payment gateway fee, what am I saving again? I looked through your article again and I STILL don’t see the “Gateway fee” that they charge for using Shopify payments and how much it is. Calls from other networks may vary and from mobiles will cost considerably more. Expand your existing reach with the PayPal pre-integrated gateway solutions. Make sure you understand which payment methods people in your target market like to use and choose a payment gateway with support for those methods. Find yours on the gateway partner page to get started. No hidden costs. You can then transfer it to your bank account, spend it through PayPal, or use your PayPal Business Debit MasterCard. Reply. Please note that 1.4% + 20p transation rate does not apply to Website Payments Pro. £20 a month and a small transaction fee gets you paid. The More I read about Shopify’s “fees” and “no fees” claim, the more CONFUSED I am. Learn More Click here to see the full breakdown of seller fees. This reminds me of a board I was on ON the Shopify site where people were burdened in confusion over shopify’s convoluted fee policy statements and the lack of clarifying responses to their questions BY shopify. **You can apply for Micropayments if your average transaction is under £5. They never leave your order form or shopping cart. Fully integrate PayPal transactions with your existing payment gateway and manage through a single view. If you’ve chosen PayPal Website Payments Pro, you’ve made a smart decision. If you’re eligible for these Merchant Rates, log in to your PayPal account and apply via the online form. One provider and one solution. The More I read about Shopify’s “fees” and “no fees” claim, the more CONFUSED I am. Merchants can choose that PayPal host the checkout pages and manage security for sales and authorizations. Payflow allows merchants to choose any Internet Merchant Account to accept debit or credit card payments and connect to any major processor. Each payment gateway supports some of these payment methods. Get Started Now or Call Sales on 0844 338 0470* Get Started * Calls cost 5p per minute from a BT landline (minimum charge 5.5p). If your website doesn’t accept your customer’s preferred payment method, you will lose sales.

The PayPal Website Payments Pro gateway lets you customize the checkout experience from start to finish, offers low monthly transaction fees, includes a convenient 3-click checkout process, and it’s a solution that lets you deal exclusively with PayPal. £20 a month and a small transaction fee gets you paid. Works with a host of PayPal pre-integrated payment solutions. Reply

” Sure, Shopify Payments do charge a payment gateway fee, but you have to pay this regardless of which payment gateway you use anyway.” So if they charge a payment gateway fee, what am I saving again? I looked through your article again and I STILL don’t see the “Gateway fee” that they charge for using Shopify payments and how much it is. This reminds me of a board I was on ON the Shopify site where people were burdened in confusion over shopify’s convoluted fee policy statements and the lack of clarifying responses to their questions BY shopify.